Case Study

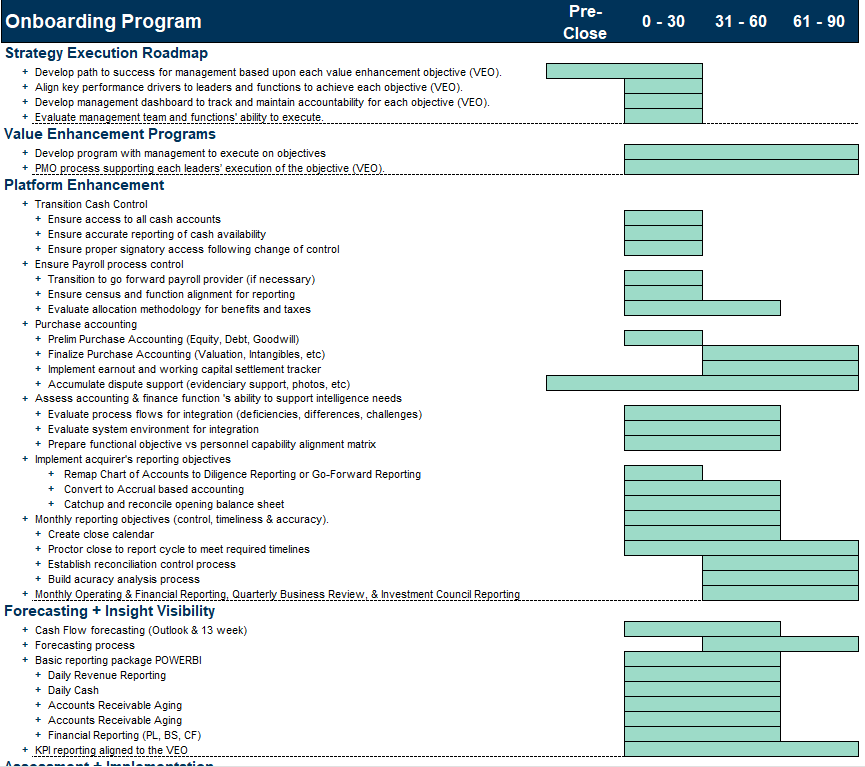

90-Day Acquisition Integration Playbook Execution

- Matthew Edwards

![]()

![]()

![]()

![]()

Manufacturing + Distribution

INDUSTRY

140

EMPLOYEES

$28M

ANNUAL REVENUE

Background

Our client maintains an aggressive acquisition strategy to gain regional market share. Our client desired a playbook to run their integration process repeatedly.

We used our playbook on this $28M tuck-in acquisition to integrate the Seller’s management, systems, and accounting functions into the platform in 90 days.

Objective

- Implement cash control over collections, disbursements, and forecasting.

- Implement close process and timeline aligned to the acquirer.

- Implement flash reporting on days 3-5.

- Prepare networking capital and purchase price allocation.

- Transition controller duties to acquirer accounting team.

- Integrate acquired business unit into platform systems.

- Train and go-live on platform systems at acquired site.

Solution

- Implemented cash control and forecasting within first 30 days.

- Implemented flash reporting, close, and reconciliation in first close cycle under interim management.

- Maintained net working capital tracking resulting in desirable, on-time settlement.

- Transitioned controller duties and supported on-time go-live of system transition.

SUCCESSFULLY INTEGRATED ACQUIRED BUSINESS UNIT WITHIN FIRST 90 DAYS.

Share this post

Article Tag 1

Article Tag 2

Article Tag 3

Article Tag 4